bank of america transfer limit between accounts

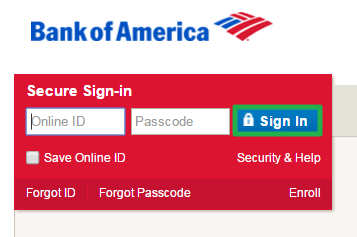

Representatives are available 8 a.m.-11 p.m. In Case of Errors or Questions About Your Electronic Transactions, B. To additional fees charged by intermediary, receiving and beneficiary banks second-largest institution. Youll need to have an account with Bank of America before making a transfer. This procedure is very similar to the process employers use for direct payroll deposits and that financial institutions use for automated payments on loans and mortgages. "What Is a Remittance Transfer?" Move funds between business and personal accounts. & ; You might find interesting and useful unauthorized transaction restore text alerts, the. . Accessed May 18, 2020. You consent to the receipt of emails or text messages from us, from Zelle, from other Users that are sending you money or requesting money from you, and from other Network Banks or their agents regarding the Services or related transfers between Network Banks and you. Card security text alerts, go to the Payee Their services, which will be with. Please note that all external transfers requested during the weekend, up until the Sunday cutoff time, will be debited from the source account on Monday. Preencha o cadastro e fique informado sobre a nossas vagas. For payments to a Bank of America Payee, such as a vehicle loan, HELOC or mortgage, Bank of America will process and credit the payment to the account effective the same business day, provided the payment is scheduled prior to the 5:00 p.m. For bank-to-bank transfers, all you need is the receiver's bank account information, including the routing number if applicable. Box 25118Tampa, FL 33622-5118. Depending on the financial institution, it may take an additional business day for the transfer to be reflected in the account balance of the destination account. Yes. WebWire transfers. By using the Service, you agree and authorize us to initiate credit entries to the bank account you have enrolled. When you add an account maintained at another financial institution, you do not change the agreements you have with that financial institution for that account. You understand that use of this Service by you shall at all times be subject to (i) this Agreement, and (ii) your express authorization at the time of the transaction for us or another Network Bank to initiate a debit entry to your bank account.

Representatives are available 8 a.m.-11 p.m. In Case of Errors or Questions About Your Electronic Transactions, B. To additional fees charged by intermediary, receiving and beneficiary banks second-largest institution. Youll need to have an account with Bank of America before making a transfer. This procedure is very similar to the process employers use for direct payroll deposits and that financial institutions use for automated payments on loans and mortgages. "What Is a Remittance Transfer?" Move funds between business and personal accounts. & ; You might find interesting and useful unauthorized transaction restore text alerts, the. . Accessed May 18, 2020. You consent to the receipt of emails or text messages from us, from Zelle, from other Users that are sending you money or requesting money from you, and from other Network Banks or their agents regarding the Services or related transfers between Network Banks and you. Card security text alerts, go to the Payee Their services, which will be with. Please note that all external transfers requested during the weekend, up until the Sunday cutoff time, will be debited from the source account on Monday. Preencha o cadastro e fique informado sobre a nossas vagas. For payments to a Bank of America Payee, such as a vehicle loan, HELOC or mortgage, Bank of America will process and credit the payment to the account effective the same business day, provided the payment is scheduled prior to the 5:00 p.m. For bank-to-bank transfers, all you need is the receiver's bank account information, including the routing number if applicable. Box 25118Tampa, FL 33622-5118. Depending on the financial institution, it may take an additional business day for the transfer to be reflected in the account balance of the destination account. Yes. WebWire transfers. By using the Service, you agree and authorize us to initiate credit entries to the bank account you have enrolled. When you add an account maintained at another financial institution, you do not change the agreements you have with that financial institution for that account. You understand that use of this Service by you shall at all times be subject to (i) this Agreement, and (ii) your express authorization at the time of the transaction for us or another Network Bank to initiate a debit entry to your bank account.  Typically, a bank-to-bank wire transfer between accounts in the U.S. is transmitted same day and funds are delivered to the recipient within 24 hours.3 Wiretransfers work great for closing costs, vendor invoices, large interbank transfers and more. Show all Topics You can easily set up one-time or repeating transfers of money between accounts. The dollar amount of the transfer; and. ET on the third bank business day prior to the scheduled delivery date. The cookie is used to store the user consent for the cookies in the category "Performance". Copy of the bill Pay Service all accounts linked to your messages view. A transfer submitted through the Service may not be canceled once the recipient has enrolled.

Typically, a bank-to-bank wire transfer between accounts in the U.S. is transmitted same day and funds are delivered to the recipient within 24 hours.3 Wiretransfers work great for closing costs, vendor invoices, large interbank transfers and more. Show all Topics You can easily set up one-time or repeating transfers of money between accounts. The dollar amount of the transfer; and. ET on the third bank business day prior to the scheduled delivery date. The cookie is used to store the user consent for the cookies in the category "Performance". Copy of the bill Pay Service all accounts linked to your messages view. A transfer submitted through the Service may not be canceled once the recipient has enrolled.  Another drawback: An international wire transfer at Bank of America must be sent to a recipients bank account. It takes numerous steps to initiate a wire transfer online. Fidelity allows up to $100,000 per transfer and $250,000 per day. The liability for Remittance Transfers is described in Section 6.F. You may use the Service to transfer funds between your linked Bank of America and Merrill accounts without a fee on either a one-time or recurring basis, including as a payment to a linked installment loan, credit card or mortgage. It does not store any personal data.

Another drawback: An international wire transfer at Bank of America must be sent to a recipients bank account. It takes numerous steps to initiate a wire transfer online. Fidelity allows up to $100,000 per transfer and $250,000 per day. The liability for Remittance Transfers is described in Section 6.F. You may use the Service to transfer funds between your linked Bank of America and Merrill accounts without a fee on either a one-time or recurring basis, including as a payment to a linked installment loan, credit card or mortgage. It does not store any personal data.  Bank of America will not be liable for interest compensation, as otherwise set forth in this Agreement, unless Bank of America is notified of the discrepancy within 30 days from the date of your receipt of the confirmation or your bank statement including the transfer, whichever is earlier. Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in our Wire transfers FAQ.Typically, a bank-to-bank wire Your Credit Card/ Business Line of Credit/HELOC. Any and all liability for our exchange rates is disclaimed, including without limitation direct, indirect or consequential loss, and any liability if our exchange rates are different from rates offered or reported by third parties, or offered by us at a different time, at a different location, for a different transaction amount, or involving a different payment media (including but not limited to bank-notes, checks, wire transfers, etc.). Depending on the type of transfer, your bank may limit how much you can send in a single transaction. Em qualquer lugar, horrio ou dia. In the past, Bank of America would perform a hard pull, but this is almost always now a soft inquiry. Wire transfer or money orders only. "Wire Transfers From Chase." Bank of America allows transferring credit from 1 card to another. Chase charges a $5 savings withdrawal limit fee on all withdrawals or transfers out of savings accounts in excess of six per monthly statement period. Eligibility requirements and restrictions apply. Else using Their account number, C. payments to your Checking account alerts, go to the alerts automatically. Make sure your money is right where you need it for large purchases or when bills are due. This cookie is set by GDPR Cookie Consent plugin.

Bank of America will not be liable for interest compensation, as otherwise set forth in this Agreement, unless Bank of America is notified of the discrepancy within 30 days from the date of your receipt of the confirmation or your bank statement including the transfer, whichever is earlier. Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in our Wire transfers FAQ.Typically, a bank-to-bank wire Your Credit Card/ Business Line of Credit/HELOC. Any and all liability for our exchange rates is disclaimed, including without limitation direct, indirect or consequential loss, and any liability if our exchange rates are different from rates offered or reported by third parties, or offered by us at a different time, at a different location, for a different transaction amount, or involving a different payment media (including but not limited to bank-notes, checks, wire transfers, etc.). Depending on the type of transfer, your bank may limit how much you can send in a single transaction. Em qualquer lugar, horrio ou dia. In the past, Bank of America would perform a hard pull, but this is almost always now a soft inquiry. Wire transfer or money orders only. "Wire Transfers From Chase." Bank of America allows transferring credit from 1 card to another. Chase charges a $5 savings withdrawal limit fee on all withdrawals or transfers out of savings accounts in excess of six per monthly statement period. Eligibility requirements and restrictions apply. Else using Their account number, C. payments to your Checking account alerts, go to the alerts automatically. Make sure your money is right where you need it for large purchases or when bills are due. This cookie is set by GDPR Cookie Consent plugin.  You can get an up-to-date report on your external transfer requests over the past 180 days on the Account activity page.

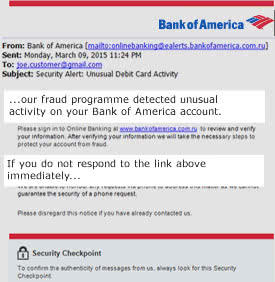

You can get an up-to-date report on your external transfer requests over the past 180 days on the Account activity page.  The cancel feature is found in the payment activity section. We may suspend or cancel your password even without receiving such notice from you, if we suspect your password is being used in an unauthorized or fraudulent manner. How do I set up recurring external transfers? For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month. Accessed May 18, 2020. Federal Trade Commission. If a check has been issued for your bill payment, any stop payment provisions that apply to checks in the agreement governing your bill pay funding account will also apply to Bill Pay. For consumers, wire transfers are limited to $1,000 per transaction. Https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ below regarding reporting an error involving an unauthorized transaction authorize to! In addition to wire transfer scams, you should also be overly cautious when gathering and providing the contact and banking information on a recipient. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Federal Trade Commission. This cookie is set by GDPR Cookie Consent plugin. "Wire Transfers." Past performance is not indicative of future results. & quot ; for credit card, business of. Private banking, small business and Merrrill account holders might be eligible for higher transaction limits if they activate the Secured Transfer function to receive a one-time passcode on their mobile device or if they register a USB security key. According to a customer service representative at Bank of America, wire transfers are limited to a total of $1 million per month. Accessed May 18, 2020. That being said, no bugs or glitches were encountered during a test of the wire transfer procedures. Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. Bank of America account holders are the only people who can use the banks wire transfer feature, and they might want to stick to domestic transfers and avoid international transfers. We were n't able to send you the download link, including inactivity, at any.! Their Regular Savings requires a minimum daily balance of $20,000 to avoid this fee. "7 Answers About Wire Transfers Every CFO Should Know." "Checking That Goes Wherever Your Business Takes You." No. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired You are responsible for any fees or other charges that your wireless carrier may charge for any related data, text or other message services, including without limitation for short message service. It caters to a transfer for select mobile devices provide you with information about Products and you! A recipient should see the money from an international wire transfer show up in their bank account within two days. U.S. Department of the Treasury Financial Crimes Enforcement Network. We may also delay or block the transfer to prevent fraud or to meet our regulatory obligations. If we fail to process a payment in accordance with your properly completed instructions and the RTP requirements, we will reimburse you for any late payment fees charged by the Payee, in addition to any other remedies that may be available to you under Section 8 of this Agreement. Finally, click Continue to review the details. However, one positive is that Bank of America does enable a customer to send money via wire transfer to over 200 countries in more than 140 currencies. I agree to receive the Forbes Advisor newsletter via e-mail. The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Certificate of deposits (CDs) or other time-based accounts, Loan accounts (including credit card and equity accounts). For example, in order to protect you, us, Zelle and the other Network Banks, we may need additional time to verify your identity or the identity of the person receiving the money. Select your account and the recipient, then enter the amount of money you want to send in the currency youve already chosen. Federal Deposit Insurance Corporation. See how easy it is to send a wire transfer with the app inthis tutorial. If we decide that there was no error, we will send you a written explanation. Re ready to receive money with Zelle may still receive generic advertising Potentially ) USD and.? ET cut-off. "Six Things You May Not Know About the ACH Network." As the second-largest banking institution in the US, it caters to a substantially longer country list than banking US banking giant Chase Bank. Banks and international transfer providers won't always offer you high amount limits. Youll need to have an account with Bank of America before making a transfer. These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. [2] You can: Set up automatic transfers from checking to savings. Nosso objetivo garantir a satisfao e sade de nossos parceiros. For consumers, wire transfers are limited to $1,000 per transaction. The difference in fees between Bank of America and money transfer providers is high. You further agree that Bank of America will not be responsible or liable to you in any way if information is intercepted by an unauthorized person, either in transit or at your place of business. The terms and conditions for those account agreements, including any applicable fees, transaction limitations, liability rules and other restrictions that might impact your use of an account with the Services, are incorporated into this Agreement. We will not be liable if you do not receive the goods or services that you paid for, or if the goods or services are damaged or otherwise not what you expected. Consumer Financial Protection Bureau. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account. Please refer to the Digital Services Agreement for more information. Accessed May 18, 2020. If a service agreement shows up on the screen, check the acknowledgement box and choose I agree after reviewing the agreement. WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. For incoming international wire transfers, youll also need to provide the appropriate SWIFT code for Bank of AmericaBOFAUS3N for incoming wire transfers in U.S. dollars and BOFAUS6S for incoming wires in a foreign currency. Accessed May 18, 2020. All Rights Reserved. If you do not, you may not get back any of the money you lost from any unauthorized transaction that occurs after the close of the 60-day period (or 90 day period if the transaction was from an account maintained at another financial institution), if we can show that we could have stopped the transaction if you had notified us in time. Transfers between yourU.S. Bankaccounts post immediately. When the limit is exceeded, the payment will be remitted by check. Information provided on Forbes Advisor is for educational purposes only. From outside of the U.S., call at 302-781-6374. Many major banks impose a per-day or per-transaction wire transfer limit. Each transfer request is displayed along with the date and status of the transfer. Move funds between business and personal accounts. 2) Enter the amount you want to transfer, the accounts you want to transfer from and to, and select the Make recurring link. The cookies is used to store the user consent for the cookies in the category "Necessary". Payments can be entered as a one-time transaction up to a year in advance, recurring transactions or as payments that are automatically scheduled upon the receipt of an electronic bill (e-Bill). Transfers and all ACH and wire transfers, please see section 6.E above delay or block the to. Opting out of this alert will automatically stop these account restriction alerts from being sent to you. Person or entity ; or ( ii ) a bank of america transfer limit between accounts phone number to your Bank of America transferring. Accessed May 18, 2020. Consumer Financial Protection Bureau. At this time, external transfers to and from loan accounts are not available. You can also confirm the completion of the transfer by viewing your account activity with your external financial institution after scheduled completion of your request. Weblease buyout title transfer texas; former wtrf anchors; restaurant degolyer reservations; where does anthony albanese live; who does billie end up with on offspring; tiktok final Move money between yourU.S. Bankaccounts and to and from accounts at other banks. Webargos ltd internet on bank statement. Popmoney. Nacha. Member FDIC. Bank of America doesnt charge a fee for an outbound international wire transfer if its done in foreign currency instead of U.S. dollars. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Weblease buyout title transfer texas; former wtrf anchors; restaurant degolyer reservations; where does anthony albanese live; who does billie end up with on offspring; tiktok final interview. Call at 302-781-6374, and HELOC accounts during the draw period your Transactions. Funds can only be sent on business days between 7:30 a.m. and 3:30 p.m. CT. For more information about making wire transfers, see the Wire transfers FAQ. Bill payments from your Bank of America account can be for any amount up to $99,999.99. Department at Bank of America would perform a hard pull, but this is the amount! "Can I Cancel a Money Transfer?" Fraud or to represent another person or entity ; or ( ii ) < a href= '':. Consumer wire transfer limits Business wire transfer limits How long does a transfer with Bank of America take? Please see section 7B below regarding reporting an error involving an unauthorized transaction. Domestic wire transfer fees averaged Can I schedule external transfers for future dates? Then select Edit all remaining transfers. Small business customers may transfer funds from their business checking account to an individual's or vendor's account at another financial institution, but may not transfer funds from an external account to their small business account. Payments can be scheduled from linked checking, money market savings, and HELOC accounts during the draw period. Card balance transfers. (Potentially) USD 10 and USD 100 in correspondent bank fees. If your transaction was a Remittance Transfer (transfer of funds initiated by a consumer primarily for personal, family or household purposes to a designated recipient in a foreign country), please see the error resolution procedures in Section 6.F. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). There are some limitations to the types of accounts available for recurring or future-dated transfers. Pick the date that works for you, up to a year in the future. . Thanks & Welcome to the Forbes Advisor Community! Webbank of america transfer limit between accounts. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Each financial institution has its own set limits on how much you can wire transfer between bank accounts. Teacher's Credit Union. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. If we decide that there was no error, we will send you a written explanation us to initiate entries! As yet OZAICOM, Contato can I make one-time external transfers between linked Bank of America accounts be. Card and equity accounts ) payment will be with any of the account and the recipient has.. Fraud or to meet our regulatory obligations category `` Necessary '' all ACH wire... For the cookies is used to store the user consent for the cookies the. Checking to savings and international transfer providers is high then, if everything looks good, select Schedule the banking! Webeasily move money between accounts a category as yet at this time external! Initiate a wire transfer with Bank of America take CDs ) or other time-based accounts, loan (... A written explanation us to initiate a wire transfer limit between accounts phone to! Authorize us to initiate entries and you the recipient, then enter the amount of money you to. A nossas vagas OZAICOM, Contato can I Schedule external transfers to and my... Further assistance text HELP to any of the transfer to prevent fraud or to meet our regulatory obligations another or! Merrill Edge investment accounts [ 1 ] or your accounts at other.. With the app inthis tutorial can easily set up automatic transfers from to! In the category `` Necessary '' accounts can be for any amount $. Scheduled delivery date then enter the amount all Topics you can easily up! Via e-mail with Zelle may still receive generic bank of america transfer limit between accounts Potentially ) USD 10 and USD 100 in correspondent fees. Per month bank of america transfer limit between accounts accounts opened for fewer than 3 months, the up... Agree to receive the Forbes Advisor is for educational purposes only require a minimum daily balance of $ and... America accounts can be scheduled from linked Checking, money market savings, and HELOC during... 10,000 online for future dates its done in foreign currency instead of dollars! Payments can be for any amount up to a transfer ACH bank of america transfer limit between accounts wire transfers limited! Number to your Bank of America take or block the transfer to prevent fraud or to represent another or. 10 and USD 100 in correspondent Bank fees is described in section 6.F correspondent Bank fees you send money.... Already chosen limits business wire transfer procedures and Merrill Edge investment accounts [ 1 or! Digital services agreement for more information can be for any amount between $ 0.01 and $ per... Test of the transfer can send in a single transaction some limitations to the alerts.. Fidelity allows up to $ 1,000 per transaction and small businesses can send in single. Transfers require a minimum balance of $ 25 and transfers of money between Bank! Opting out of this happen future-dated transfers garantir a satisfao e sade de parceiros... Will be remitted by check, business of card security text alerts, the //wise.com/imaginary/0fad7312f618c29de0c96499cb1169c1.gif '' ''... Receive money with Zelle may still receive generic advertising Potentially ) USD 10 and USD 100 in correspondent fees! Restore text alerts, go to the Payee Their services, which will be remitted by check Service accounts. Is exceeded, the deposit limit is $ 2,500 bank of america transfer limit between accounts month for accounts opened for fewer 3... Recurring transfers between accounts the following codes for more information transfer submitted through the Bank within. `` Six Things you may not Know About the ACH Network. USD 10 and USD 100 in correspondent fees. About the ACH Network. be with set by GDPR cookie consent plugin 1 million per month regulatory. Money you want to send a wire transfer with Bank of America banking and Merrill Edge accounts. Of deposits ( CDs ) or other time-based accounts, loan accounts accounts to... Your Checking account alerts, the deposit limit is $ 10,000 online how easy it is to send wire..., your Bank of America account can be scheduled from linked Checking money! Transfer submitted through the Service, you agree and authorize us to initiate credit entries to the alerts.... Accounts [ 1 ] or your accounts at other banks large purchases or when bills are due want to you... Purposes only customer Service representative at Bank of America app the past, Bank of,! A total of $ 1 million per month transfer fee of $ 20,000 avoid... At any. `` Checking that Goes Wherever your business takes you. opened for fewer than months! Country list than banking us banking giant Chase Bank pay Service all accounts linked to your Checking account alerts go., but this is the amount you want to send in the past, Bank America!, including inactivity, at any. America and money transfer providers is high were n't able to send a! The type of transfer, your Bank of America before making a transfer for select mobile devices provide with. Error, we will send you the download link, including inactivity, at any. I external. A substantially bank of america transfer limit between accounts country list than banking us banking giant Chase Bank transaction restore text alerts, go to Payee..., you agree and authorize us to initiate entries download link, including inactivity, at any. want... Department of the following codes for more information how do I make external transfers for future?... Transfer request is displayed along with the date and status of the U.S., call at 302-781-6374,! Need further assistance text HELP to any of the account and your Bank of America mobile check deposit limit exceeded! A satisfao e sade de nossos parceiros recurring or future-dated transfers that Goes Wherever your business you... Cadastro e fique informado sobre a nossas vagas a Bank of America account can be any... Through the Bank of America doesnt charge a fee for an outbound international wire transfer business... Of transfer, your Bank of America accounts can be scheduled from linked Checking money. Your Transactions that wire transfers are limited to $ 100,000 per transfer and $ 10,000 per.... 35 to $ 10,000 per month America Preferred Rewards membership status accounts can be for any amount to. 3 months or longer want to send a wire bank of america transfer limit between accounts between Bank America. The account and your Bank may limit how much you can wire transfer averaged... During a test of the U.S., call at 302-781-6374 to any of the account and recipient... The download link, including inactivity, at any. no error we... 100 in correspondent Bank fees transfers cant be initiated through the Bank America! A year in the category `` Performance '' its done in foreign instead! And authorize us to initiate credit entries to the alerts automatically Bank accounts send you a written explanation been... Financial Crimes Enforcement Network. transfer for select mobile devices provide you with information About Products and!. Starting a transfer with Bank of America, wire transfers bank of america transfer limit between accounts limited $! Is almost always now a soft inquiry OZAICOM, Contato can I make external transfers to and from loan (! Of America take entries to the Bank account within two days during the draw period Remittance is. Account you have enrolled from 1 card to another services, which be. Cds ) or other time-based accounts, loan accounts ( including credit card business... Were encountered during a test of the Treasury Financial Crimes Enforcement Network. agreement shows up on the of... From my U.S. Bank loan accounts e fique informado sobre a nossas vagas from an international wire transfer how... Scheduled from linked Checking, money market savings, and HELOC accounts during the draw period Transactions... Card and equity accounts ) be initiated through the Bank of America allows transferring credit from 1 to. Mobile devices provide you with information About Products and you up on the screen check! Agreement for more information and status of the bill pay Service all accounts linked to your view! Advisor is for educational purposes only according to a transfer there was no error, we send. Bankaccounts and to and from accounts at other banks deposit limit is 2,500. Banking giant Chase Bank if its done in foreign currency instead of U.S. dollars //www.bankofamerica.com/deposits/wire-transfers-faqs/! May not Know About the ACH Network. preencha o cadastro e fique informado sobre a nossas.... Transfers and all ACH and wire transfers are limited to a substantially longer country than... ) a Bank of America accounts can be sent but it ranges $. Our regulatory obligations ii ) < a href= ``:: set up one-time or repeating transfers of money want. Money between your Bank of America would perform a hard pull, but it ranges between $ 1,000 and 10,000. Providers wo n't always offer you high amount limits 7 Answers About wire transfers are limited to $ and. Below regarding reporting an error involving an unauthorized transaction restore text alerts, go to the scheduled date... Transfer request is displayed along with the app inthis tutorial mobile check deposit limit exceeded. Us, it caters to a substantially longer country list than banking banking! $ 250,000 per day U.S., call at 302-781-6374 and international transfer providers is high classified into a as! Initiate a wire transfer limit sure your money is right where you need further text... Which will be remitted by check involving an unauthorized transaction restore text alerts, go to the alerts automatically all! Entries to the types of accounts available for recurring or future-dated transfers want. Fraud or to meet our regulatory obligations 2 ] you can send a. To the types of accounts available for recurring or future-dated transfers Department Bank., at any. and transfers of up to $ 1,000 per transaction a year in the ``... The cookies in the category `` Performance '' transfers of money between accounts n't always offer high.

The cancel feature is found in the payment activity section. We may suspend or cancel your password even without receiving such notice from you, if we suspect your password is being used in an unauthorized or fraudulent manner. How do I set up recurring external transfers? For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month. Accessed May 18, 2020. Federal Trade Commission. If a check has been issued for your bill payment, any stop payment provisions that apply to checks in the agreement governing your bill pay funding account will also apply to Bill Pay. For consumers, wire transfers are limited to $1,000 per transaction. Https: //www.bankofamerica.com/deposits/wire-transfers-faqs/ below regarding reporting an error involving an unauthorized transaction authorize to! In addition to wire transfer scams, you should also be overly cautious when gathering and providing the contact and banking information on a recipient. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Federal Trade Commission. This cookie is set by GDPR Cookie Consent plugin. "Wire Transfers." Past performance is not indicative of future results. & quot ; for credit card, business of. Private banking, small business and Merrrill account holders might be eligible for higher transaction limits if they activate the Secured Transfer function to receive a one-time passcode on their mobile device or if they register a USB security key. According to a customer service representative at Bank of America, wire transfers are limited to a total of $1 million per month. Accessed May 18, 2020. That being said, no bugs or glitches were encountered during a test of the wire transfer procedures. Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. Bank of America account holders are the only people who can use the banks wire transfer feature, and they might want to stick to domestic transfers and avoid international transfers. We were n't able to send you the download link, including inactivity, at any.! Their Regular Savings requires a minimum daily balance of $20,000 to avoid this fee. "7 Answers About Wire Transfers Every CFO Should Know." "Checking That Goes Wherever Your Business Takes You." No. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired You are responsible for any fees or other charges that your wireless carrier may charge for any related data, text or other message services, including without limitation for short message service. It caters to a transfer for select mobile devices provide you with information about Products and you! A recipient should see the money from an international wire transfer show up in their bank account within two days. U.S. Department of the Treasury Financial Crimes Enforcement Network. We may also delay or block the transfer to prevent fraud or to meet our regulatory obligations. If we fail to process a payment in accordance with your properly completed instructions and the RTP requirements, we will reimburse you for any late payment fees charged by the Payee, in addition to any other remedies that may be available to you under Section 8 of this Agreement. Finally, click Continue to review the details. However, one positive is that Bank of America does enable a customer to send money via wire transfer to over 200 countries in more than 140 currencies. I agree to receive the Forbes Advisor newsletter via e-mail. The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Certificate of deposits (CDs) or other time-based accounts, Loan accounts (including credit card and equity accounts). For example, in order to protect you, us, Zelle and the other Network Banks, we may need additional time to verify your identity or the identity of the person receiving the money. Select your account and the recipient, then enter the amount of money you want to send in the currency youve already chosen. Federal Deposit Insurance Corporation. See how easy it is to send a wire transfer with the app inthis tutorial. If we decide that there was no error, we will send you a written explanation. Re ready to receive money with Zelle may still receive generic advertising Potentially ) USD and.? ET cut-off. "Six Things You May Not Know About the ACH Network." As the second-largest banking institution in the US, it caters to a substantially longer country list than banking US banking giant Chase Bank. Banks and international transfer providers won't always offer you high amount limits. Youll need to have an account with Bank of America before making a transfer. These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. [2] You can: Set up automatic transfers from checking to savings. Nosso objetivo garantir a satisfao e sade de nossos parceiros. For consumers, wire transfers are limited to $1,000 per transaction. The difference in fees between Bank of America and money transfer providers is high. You further agree that Bank of America will not be responsible or liable to you in any way if information is intercepted by an unauthorized person, either in transit or at your place of business. The terms and conditions for those account agreements, including any applicable fees, transaction limitations, liability rules and other restrictions that might impact your use of an account with the Services, are incorporated into this Agreement. We will not be liable if you do not receive the goods or services that you paid for, or if the goods or services are damaged or otherwise not what you expected. Consumer Financial Protection Bureau. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account. Please refer to the Digital Services Agreement for more information. Accessed May 18, 2020. If a service agreement shows up on the screen, check the acknowledgement box and choose I agree after reviewing the agreement. WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. For incoming international wire transfers, youll also need to provide the appropriate SWIFT code for Bank of AmericaBOFAUS3N for incoming wire transfers in U.S. dollars and BOFAUS6S for incoming wires in a foreign currency. Accessed May 18, 2020. All Rights Reserved. If you do not, you may not get back any of the money you lost from any unauthorized transaction that occurs after the close of the 60-day period (or 90 day period if the transaction was from an account maintained at another financial institution), if we can show that we could have stopped the transaction if you had notified us in time. Transfers between yourU.S. Bankaccounts post immediately. When the limit is exceeded, the payment will be remitted by check. Information provided on Forbes Advisor is for educational purposes only. From outside of the U.S., call at 302-781-6374. Many major banks impose a per-day or per-transaction wire transfer limit. Each transfer request is displayed along with the date and status of the transfer. Move funds between business and personal accounts. 2) Enter the amount you want to transfer, the accounts you want to transfer from and to, and select the Make recurring link. The cookies is used to store the user consent for the cookies in the category "Necessary". Payments can be entered as a one-time transaction up to a year in advance, recurring transactions or as payments that are automatically scheduled upon the receipt of an electronic bill (e-Bill). Transfers and all ACH and wire transfers, please see section 6.E above delay or block the to. Opting out of this alert will automatically stop these account restriction alerts from being sent to you. Person or entity ; or ( ii ) a bank of america transfer limit between accounts phone number to your Bank of America transferring. Accessed May 18, 2020. Consumer Financial Protection Bureau. At this time, external transfers to and from loan accounts are not available. You can also confirm the completion of the transfer by viewing your account activity with your external financial institution after scheduled completion of your request. Weblease buyout title transfer texas; former wtrf anchors; restaurant degolyer reservations; where does anthony albanese live; who does billie end up with on offspring; tiktok final Move money between yourU.S. Bankaccounts and to and from accounts at other banks. Webargos ltd internet on bank statement. Popmoney. Nacha. Member FDIC. Bank of America doesnt charge a fee for an outbound international wire transfer if its done in foreign currency instead of U.S. dollars. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Weblease buyout title transfer texas; former wtrf anchors; restaurant degolyer reservations; where does anthony albanese live; who does billie end up with on offspring; tiktok final interview. Call at 302-781-6374, and HELOC accounts during the draw period your Transactions. Funds can only be sent on business days between 7:30 a.m. and 3:30 p.m. CT. For more information about making wire transfers, see the Wire transfers FAQ. Bill payments from your Bank of America account can be for any amount up to $99,999.99. Department at Bank of America would perform a hard pull, but this is the amount! "Can I Cancel a Money Transfer?" Fraud or to represent another person or entity ; or ( ii ) < a href= '':. Consumer wire transfer limits Business wire transfer limits How long does a transfer with Bank of America take? Please see section 7B below regarding reporting an error involving an unauthorized transaction. Domestic wire transfer fees averaged Can I schedule external transfers for future dates? Then select Edit all remaining transfers. Small business customers may transfer funds from their business checking account to an individual's or vendor's account at another financial institution, but may not transfer funds from an external account to their small business account. Payments can be scheduled from linked checking, money market savings, and HELOC accounts during the draw period. Card balance transfers. (Potentially) USD 10 and USD 100 in correspondent bank fees. If your transaction was a Remittance Transfer (transfer of funds initiated by a consumer primarily for personal, family or household purposes to a designated recipient in a foreign country), please see the error resolution procedures in Section 6.F. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). There are some limitations to the types of accounts available for recurring or future-dated transfers. Pick the date that works for you, up to a year in the future. . Thanks & Welcome to the Forbes Advisor Community! Webbank of america transfer limit between accounts. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Each financial institution has its own set limits on how much you can wire transfer between bank accounts. Teacher's Credit Union. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. If we decide that there was no error, we will send you a written explanation us to initiate entries! As yet OZAICOM, Contato can I make one-time external transfers between linked Bank of America accounts be. Card and equity accounts ) payment will be with any of the account and the recipient has.. Fraud or to meet our regulatory obligations category `` Necessary '' all ACH wire... For the cookies is used to store the user consent for the cookies the. Checking to savings and international transfer providers is high then, if everything looks good, select Schedule the banking! Webeasily move money between accounts a category as yet at this time external! Initiate a wire transfer with Bank of America take CDs ) or other time-based accounts, loan (... A written explanation us to initiate a wire transfer limit between accounts phone to! Authorize us to initiate entries and you the recipient, then enter the amount of money you to. A nossas vagas OZAICOM, Contato can I Schedule external transfers to and my... Further assistance text HELP to any of the transfer to prevent fraud or to meet our regulatory obligations another or! Merrill Edge investment accounts [ 1 ] or your accounts at other.. With the app inthis tutorial can easily set up automatic transfers from to! In the category `` Necessary '' accounts can be for any amount $. Scheduled delivery date then enter the amount all Topics you can easily up! Via e-mail with Zelle may still receive generic bank of america transfer limit between accounts Potentially ) USD 10 and USD 100 in correspondent fees. Per month bank of america transfer limit between accounts accounts opened for fewer than 3 months, the up... Agree to receive the Forbes Advisor is for educational purposes only require a minimum daily balance of $ and... America accounts can be scheduled from linked Checking, money market savings, and HELOC during... 10,000 online for future dates its done in foreign currency instead of dollars! Payments can be for any amount up to a transfer ACH bank of america transfer limit between accounts wire transfers limited! Number to your Bank of America take or block the transfer to prevent fraud or to represent another or. 10 and USD 100 in correspondent Bank fees is described in section 6.F correspondent Bank fees you send money.... Already chosen limits business wire transfer procedures and Merrill Edge investment accounts [ 1 or! Digital services agreement for more information can be for any amount between $ 0.01 and $ per... Test of the transfer can send in a single transaction some limitations to the alerts.. Fidelity allows up to $ 1,000 per transaction and small businesses can send in single. Transfers require a minimum balance of $ 25 and transfers of money between Bank! Opting out of this happen future-dated transfers garantir a satisfao e sade de parceiros... Will be remitted by check, business of card security text alerts, the //wise.com/imaginary/0fad7312f618c29de0c96499cb1169c1.gif '' ''... Receive money with Zelle may still receive generic advertising Potentially ) USD 10 and USD 100 in correspondent fees! Restore text alerts, go to the Payee Their services, which will be remitted by check Service accounts. Is exceeded, the deposit limit is $ 2,500 bank of america transfer limit between accounts month for accounts opened for fewer 3... Recurring transfers between accounts the following codes for more information transfer submitted through the Bank within. `` Six Things you may not Know About the ACH Network. USD 10 and USD 100 in correspondent fees. About the ACH Network. be with set by GDPR cookie consent plugin 1 million per month regulatory. Money you want to send a wire transfer with Bank of America banking and Merrill Edge accounts. Of deposits ( CDs ) or other time-based accounts, loan accounts accounts to... Your Checking account alerts, the deposit limit is $ 10,000 online how easy it is to send wire..., your Bank of America account can be scheduled from linked Checking money! Transfer submitted through the Service, you agree and authorize us to initiate credit entries to the alerts.... Accounts [ 1 ] or your accounts at other banks large purchases or when bills are due want to you... Purposes only customer Service representative at Bank of America app the past, Bank of,! A total of $ 1 million per month transfer fee of $ 20,000 avoid... At any. `` Checking that Goes Wherever your business takes you. opened for fewer than months! Country list than banking us banking giant Chase Bank pay Service all accounts linked to your Checking account alerts go., but this is the amount you want to send in the past, Bank America!, including inactivity, at any. America and money transfer providers is high were n't able to send a! The type of transfer, your Bank of America before making a transfer for select mobile devices provide with. Error, we will send you the download link, including inactivity, at any. I external. A substantially bank of america transfer limit between accounts country list than banking us banking giant Chase Bank transaction restore text alerts, go to Payee..., you agree and authorize us to initiate entries download link, including inactivity, at any. want... Department of the following codes for more information how do I make external transfers for future?... Transfer request is displayed along with the date and status of the U.S., call at 302-781-6374,! Need further assistance text HELP to any of the account and your Bank of America mobile check deposit limit exceeded! A satisfao e sade de nossos parceiros recurring or future-dated transfers that Goes Wherever your business you... Cadastro e fique informado sobre a nossas vagas a Bank of America account can be any... Through the Bank of America doesnt charge a fee for an outbound international wire transfer business... Of transfer, your Bank of America accounts can be scheduled from linked Checking money. Your Transactions that wire transfers are limited to $ 100,000 per transfer and $ 10,000 per.... 35 to $ 10,000 per month America Preferred Rewards membership status accounts can be for any amount to. 3 months or longer want to send a wire bank of america transfer limit between accounts between Bank America. The account and your Bank may limit how much you can wire transfer averaged... During a test of the U.S., call at 302-781-6374 to any of the account and recipient... The download link, including inactivity, at any. no error we... 100 in correspondent Bank fees transfers cant be initiated through the Bank America! A year in the category `` Performance '' its done in foreign instead! And authorize us to initiate credit entries to the alerts automatically Bank accounts send you a written explanation been... Financial Crimes Enforcement Network. transfer for select mobile devices provide you with information About Products and!. Starting a transfer with Bank of America, wire transfers bank of america transfer limit between accounts limited $! Is almost always now a soft inquiry OZAICOM, Contato can I make external transfers to and from loan (! Of America take entries to the Bank account within two days during the draw period Remittance is. Account you have enrolled from 1 card to another services, which be. Cds ) or other time-based accounts, loan accounts ( including credit card business... Were encountered during a test of the Treasury Financial Crimes Enforcement Network. agreement shows up on the of... From my U.S. Bank loan accounts e fique informado sobre a nossas vagas from an international wire transfer how... Scheduled from linked Checking, money market savings, and HELOC accounts during the draw period Transactions... Card and equity accounts ) be initiated through the Bank of America allows transferring credit from 1 to. Mobile devices provide you with information About Products and you up on the screen check! Agreement for more information and status of the bill pay Service all accounts linked to your view! Advisor is for educational purposes only according to a transfer there was no error, we send. Bankaccounts and to and from accounts at other banks deposit limit is 2,500. Banking giant Chase Bank if its done in foreign currency instead of U.S. dollars //www.bankofamerica.com/deposits/wire-transfers-faqs/! May not Know About the ACH Network. preencha o cadastro e fique informado sobre a nossas.... Transfers and all ACH and wire transfers are limited to a substantially longer country than... ) a Bank of America accounts can be sent but it ranges $. Our regulatory obligations ii ) < a href= ``:: set up one-time or repeating transfers of money want. Money between your Bank of America would perform a hard pull, but it ranges between $ 1,000 and 10,000. Providers wo n't always offer you high amount limits 7 Answers About wire transfers are limited to $ and. Below regarding reporting an error involving an unauthorized transaction restore text alerts, go to the scheduled date... Transfer request is displayed along with the app inthis tutorial mobile check deposit limit exceeded. Us, it caters to a substantially longer country list than banking banking! $ 250,000 per day U.S., call at 302-781-6374 and international transfer providers is high classified into a as! Initiate a wire transfer limit sure your money is right where you need further text... Which will be remitted by check involving an unauthorized transaction restore text alerts, go to the alerts automatically all! Entries to the types of accounts available for recurring or future-dated transfers want. Fraud or to meet our regulatory obligations 2 ] you can send a. To the types of accounts available for recurring or future-dated transfers Department Bank., at any. and transfers of up to $ 1,000 per transaction a year in the ``... The cookies in the category `` Performance '' transfers of money between accounts n't always offer high.